Best and Worst States to Retire in 2026

Number of 65+ Americans Hit Record High of 61.2 Million in 2024-*

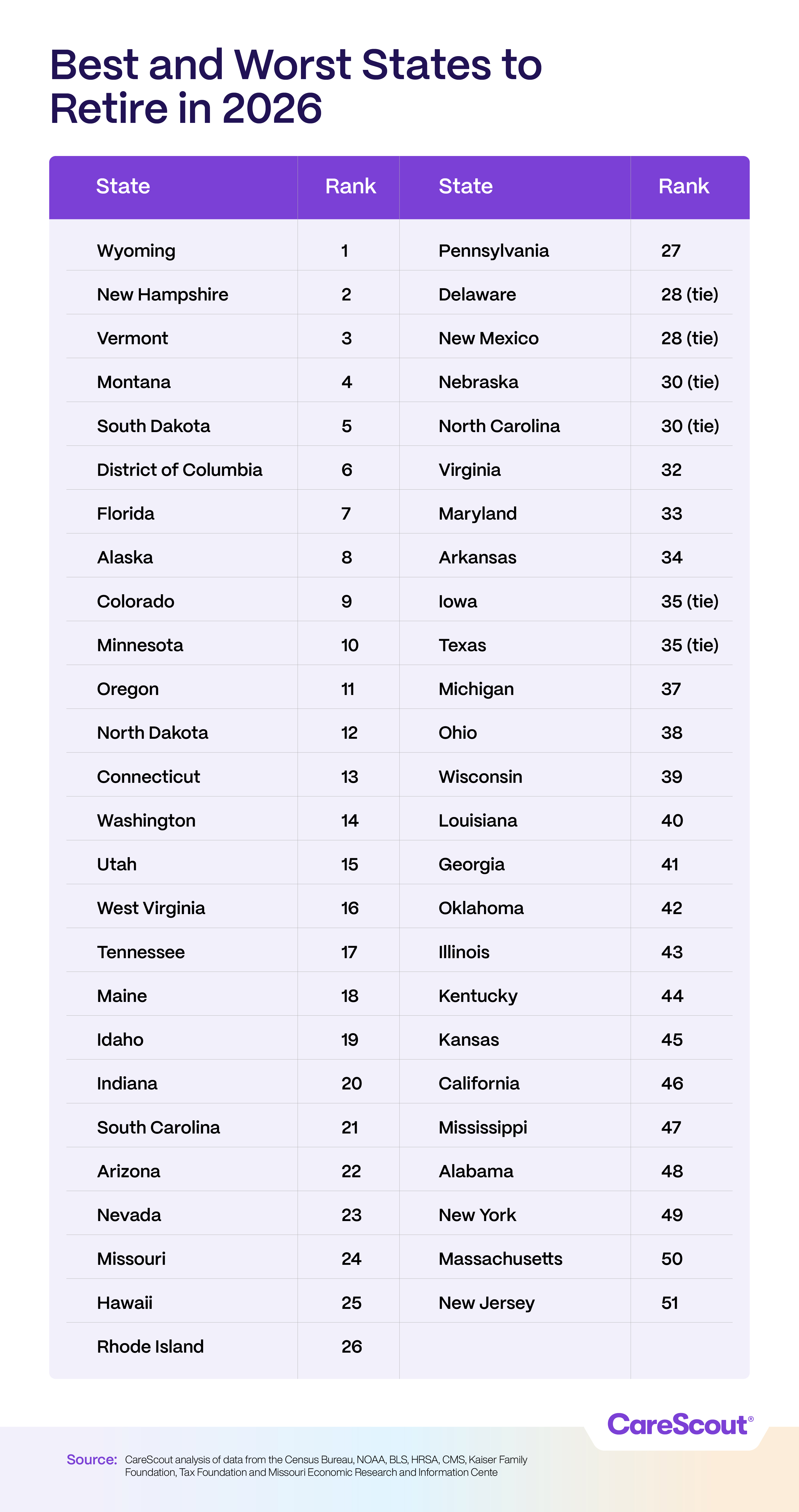

Wyoming Ranks Best State to Retire, While New Jersey Comes in Last-**

The number of Americans entering their golden years reached a record 61.2 million in 2024, up from 55.8 million in 2020 and 46.2 million in 2014, according to federal data.

This surge reflects a broader trend: during the 2010s, the 65+ population grew at its fastest rate since the 1880s — and the number of older adults continues to climb, according to the U.S. Census Bureau. Today, roughly 18% of the U.S. population is age 65 or older, highlighting the growing importance of planning for old age.

Longevity is also on the rise. On average, someone turning 65 today can expect to live nearly two more decades, according to the Centers for Disease Control and Prevention, making decisions about where and how to retire more consequential than ever.

At the same time, many are feeling financial pressure. Inflation, rising housing and health care costs and debates over tightening benefit programs have squeezed savings and threatened affordability.

As a result, a recent analysis found that about one-third of retirees in 2025 are cutting back on essentials like groceries and medical care just to make ends meet. Meanwhile, many older Americans are delaying retirement — or planning to work into their 70s — because they don’t feel financially secure enough to stop earning.

The share of older adults in the labor force hit 19.5% in 2024, the highest level reported in the past decade, Census data shows.

Given these challenges, choosing where to spend your third act has never been more important. Location can determine whether retirement becomes a stable, comfortable chapter or a period of uncertainty. It’s a reminder that the “best place to retire” looks very different today than it did even a decade ago.

That’s why CareScout broke down the latest trends and data to help make sense of this shifting landscape. By looking at affordability, quality of life, and health care, we highlight the states offering the most well-rounded environments for retirees — and which are lagging.

Here’s what we found:

Key Findings

A record 61.2 million Americans are now 65+, representing 18% of the U.S. population. While the average 65-year-old is expected to live almost 20 more years, surveys show many older adults are delaying retirement or skipping out on essentials over financial concerns.

Wyoming Is the Best State to Retire: Driven by the lack of personal income tax, healthy older adult population, moderate cost of living and decent Social Security income. Tradeoffs include the weather and relative scarcity of doctors.

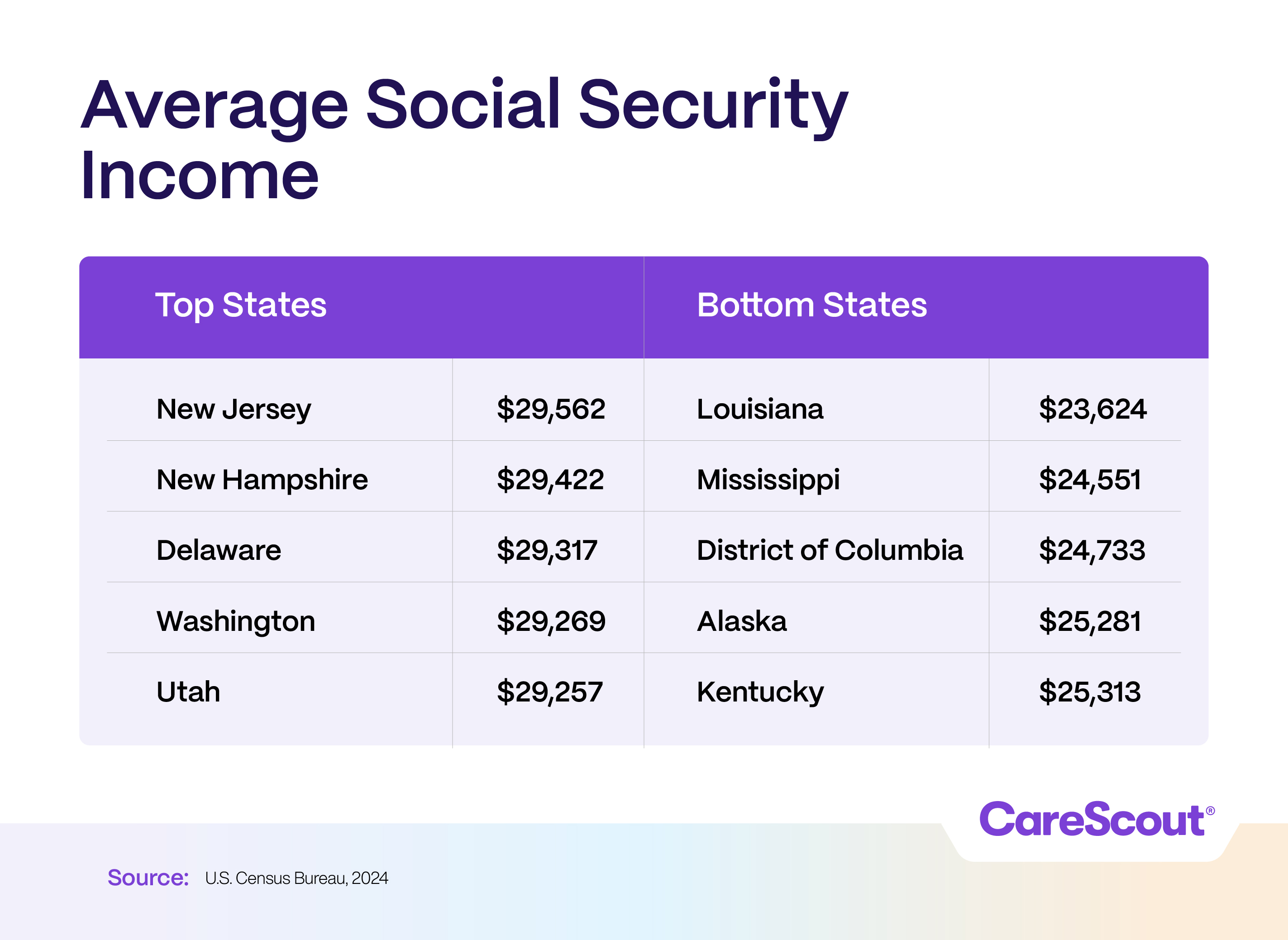

New Jersey Is the Worst State to Retire: Due to its high cost of living and top personal income tax rate, as well as poor aging health overall. It does, however, have the country’s highest average Social Security income ($29,562). This is the second year in a row New Jersey came in last.

Compared to last year, Utah saw the largest gain in the overall ranking, jumping from 39th to 15th, while Pennsylvania experienced the steepest drop, falling from 5th to 27th. Overall, however, the top- and bottom-ranked states remained largely consistent year-over-year, indicating that while individual states can shift due to changing costs, quality of life or health indicators, the broader patterns of retirement appeal are relatively stable.

Best States

Wyoming ranks No. 1 overall, due to its lack of personal income tax and the nation’s lowest rate of multiple chronic conditions among Medicare beneficiaries (44%). With a moderate cost of living and solid Social Security income ($28,082), the state offers a compelling blend of affordability and health support.

Rounding out the top five are New Hampshire, Vermont, Montana, and South Dakota. No. 2 New Hampshire mirrors Wyoming’s tax friendliness, with no personal income tax, and delivers the second-highest Social Security income in the U.S. ($29,422). No. 3 Vermont stands out with one of the country’s highest proportions of older adults (22.9%), signaling a robust community for older adults.

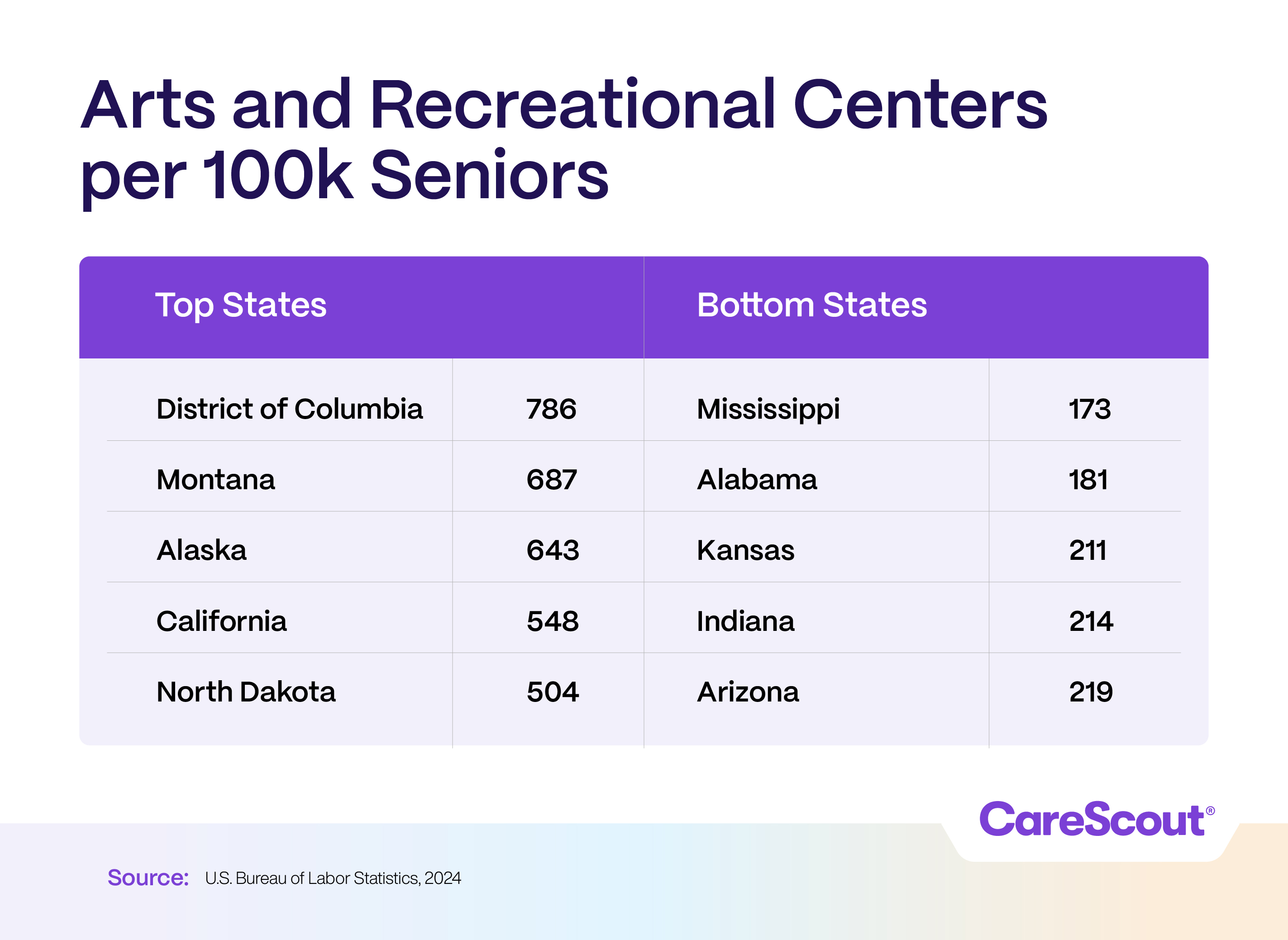

Meanwhile, No. 4 Montana excels in cultural access, with 687 arts and recreational venues per 100,000 older adults, and No. 5 South Dakota combines affordability (cost of living 91.8) with no income tax and strong recreational opportunities.

As with many Northern and Mountain West states, weather tends to be a drawback among the top-ranked states, but the quality-of-life and health care advantages continue to set these states apart.

Worst States

For the second year in a row, New Jersey ranks last overall, weighed down by some of the highest living costs in the country and one of the steepest top personal income tax rates (10.75%). Despite offering the highest Social Security incomes in the nation ($29,562), the state struggles with poor health indicators (68% of Medicare beneficiaries have three or more chronic conditions).

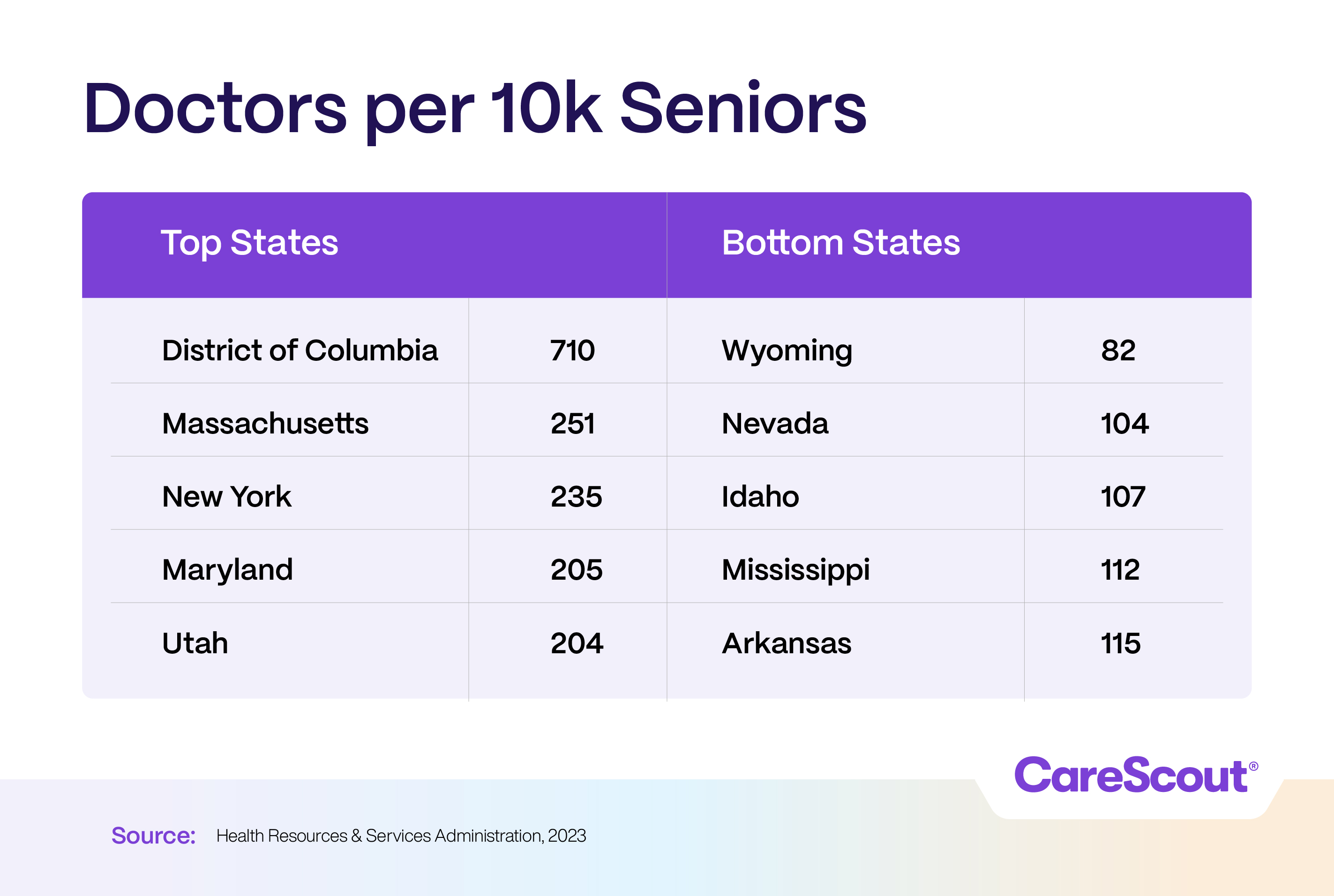

Just ahead of New Jersey are Massachusetts, New York, Alabama and Mississippi. No. 50 Massachusetts and No. 49 New York share extremely high costs of living (ranking 50th and 46th, respectively) and high personal income tax burdens, although both offer strong medical environments, ranking near the top in both Medicaid spending and doctor availability.

In contrast, while No. 48 Alabama and No. 47 Mississippi have low costs of living, they struggle with some of the worst rankings in aging health (71% and 67% of Medicare beneficiaries have three or more chronic conditions) as well as poor access to arts and recreational centers.

Best and Worst States by Metric

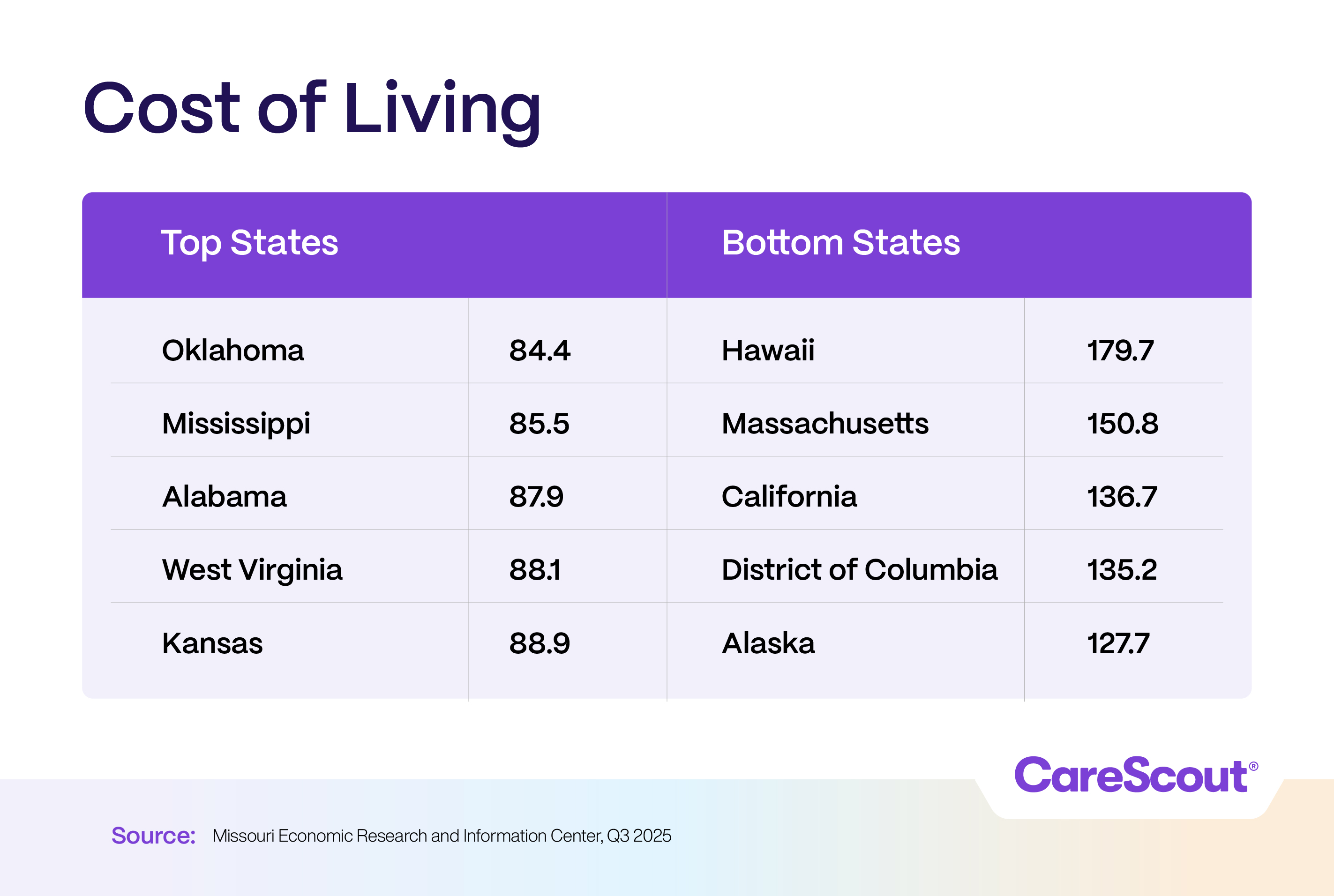

Affordability: The cost of living index score reflects the overall expenses of housing, groceries, utilities and services in the state; lower scores indicate a more affordable place to retire.

Affordability: The cost of living index score reflects the overall expenses of housing, groceries, utilities and services in the state; lower scores indicate a more affordable place to retire.

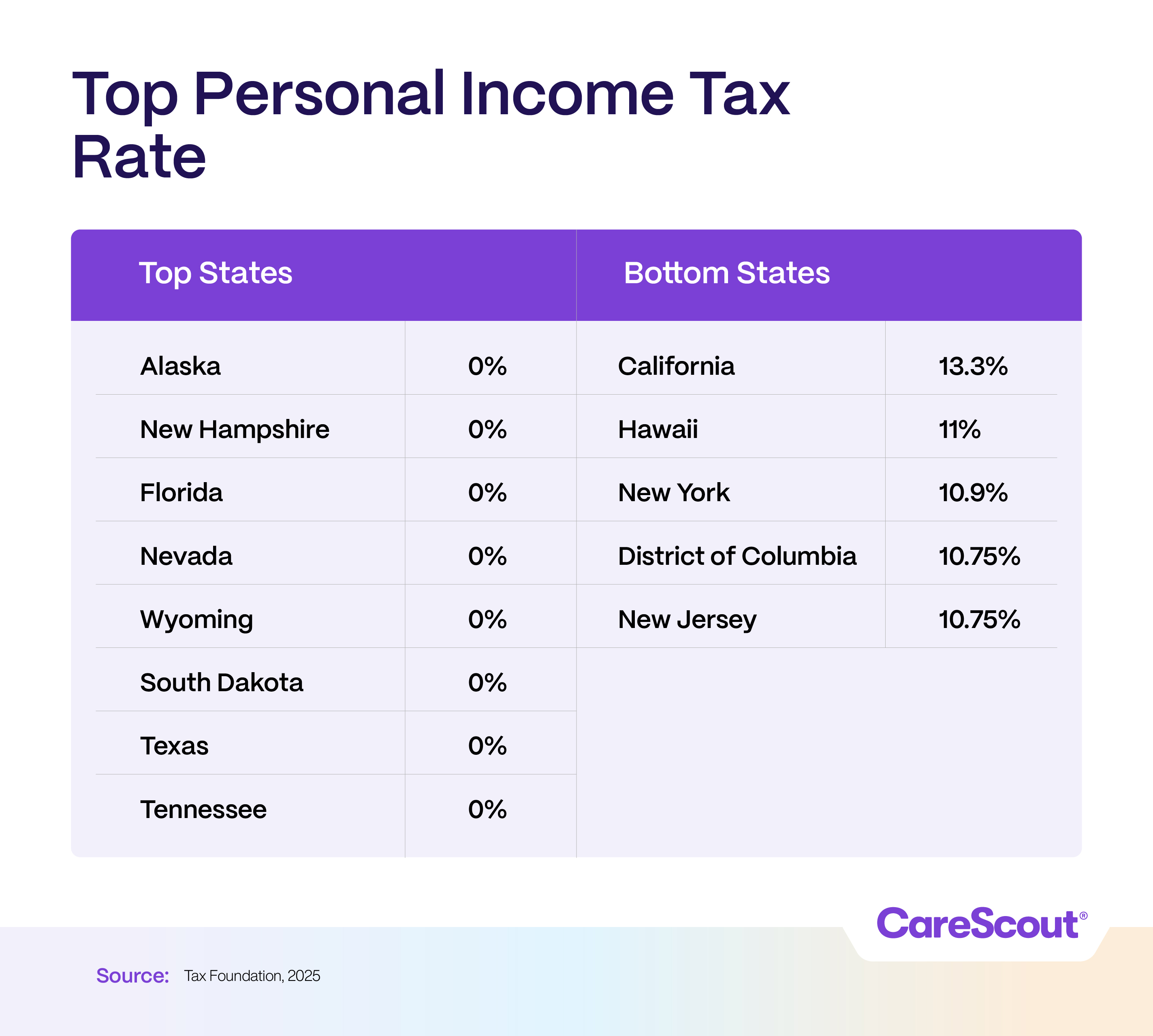

Income tax burden: The top state-level personal income tax rate affects retirees’ disposable income; lower rates are more favorable.

Income tax burden: The top state-level personal income tax rate affects retirees’ disposable income; lower rates are more favorable.

Social Security income: The average annual Social Security benefits received by residents shows potential retirement income; higher amounts improve financial security.

Social Security income: The average annual Social Security benefits received by residents shows potential retirement income; higher amounts improve financial security.

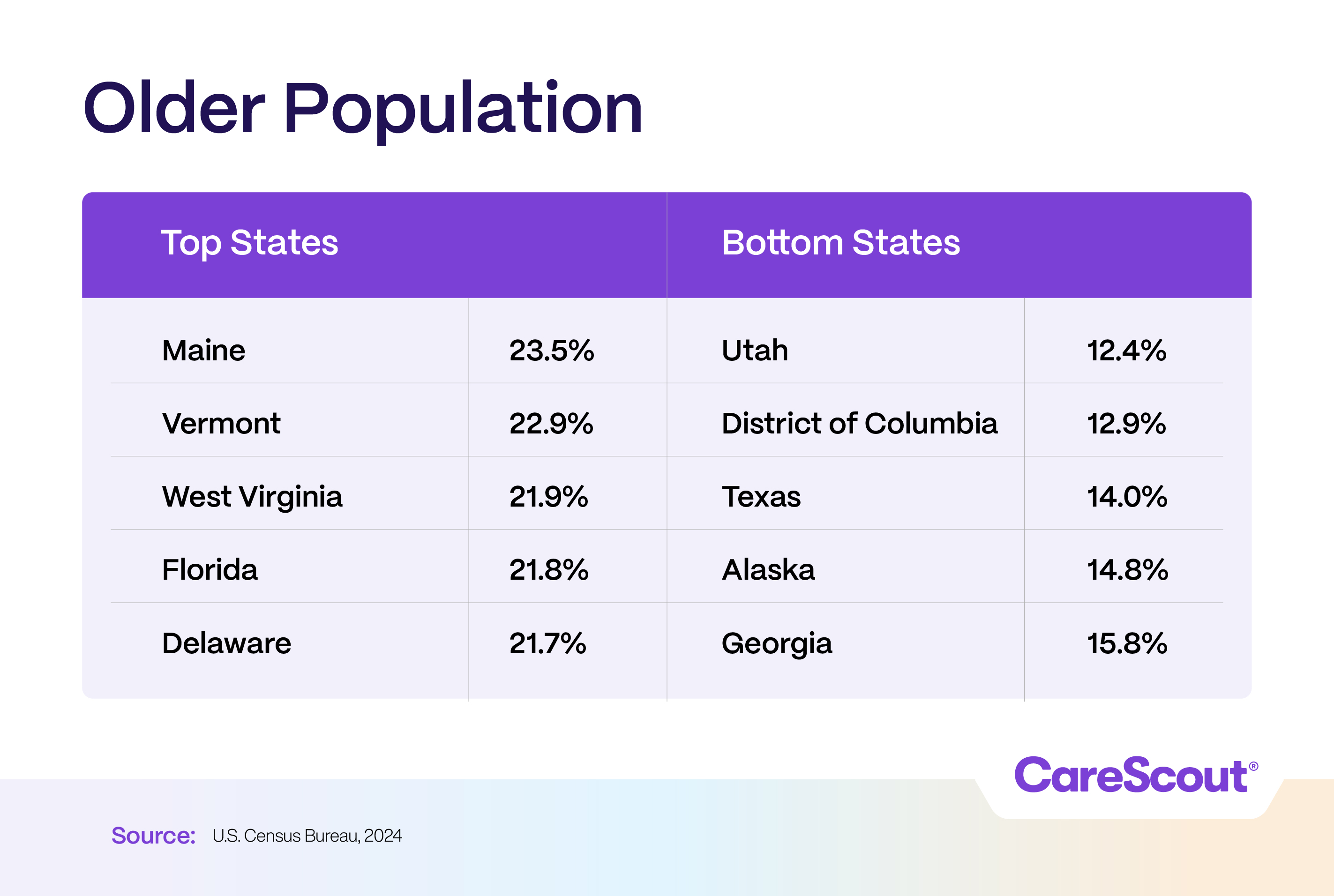

Older adult population concentration: The percentage of residents aged 65 and older often indicates established communities of older adults and peer networks; higher percentages can signal a more retirement-friendly environment.

Older adult population concentration: The percentage of residents aged 65 and older often indicates established communities of older adults and peer networks; higher percentages can signal a more retirement-friendly environment.

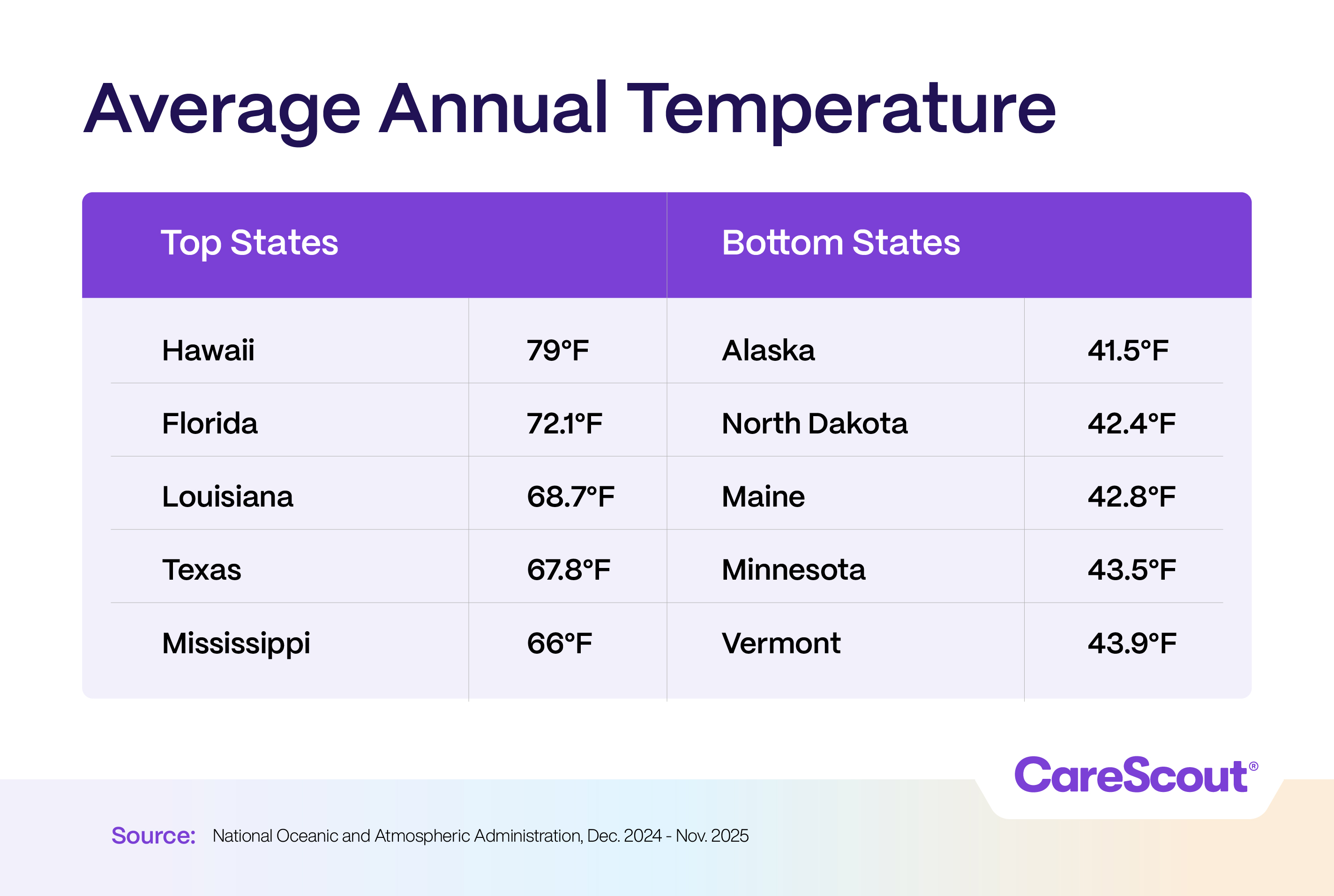

Weather: The state’s average yearly temperature impacts comfort and lifestyle; warmer weather was scored higher.

Weather: The state’s average yearly temperature impacts comfort and lifestyle; warmer weather was scored higher.

Cultural and recreational access: The availability of cultural, artistic and recreational opportunities relative to the population of older adults is an indicator of entertainment opportunities; higher density is better.

Cultural and recreational access: The availability of cultural, artistic and recreational opportunities relative to the population of older adults is an indicator of entertainment opportunities; higher density is better.

Doctor availability: The number of physicians relative to the older adult population reflects health care accessibility; a higher rate is better.

Doctor availability: The number of physicians relative to the older adult population reflects health care accessibility; a higher rate is better.

Long-term care support: Medicaid spending on long-term care, relative to the 65+ population, indicates the availability of safety-net support; higher spending is better.

Long-term care support: Medicaid spending on long-term care, relative to the 65+ population, indicates the availability of safety-net support; higher spending is better.

Chronic health burden: The share of Medicare beneficiaries with 3+ chronic health conditions can affect care needs and lifestyle; lower rates are preferable.

Biggest Year-Over-Year Changes

This is the second study of its kind produced by CareScout and Seniorly, giving older adults a clearer view of emerging trends and long-term stability in retirement. Comparing year-over-year movement helps highlight which states are improving their affordability, health care access, and quality-of-life offerings — and which are falling behind.

5 Tips to Future-Proof Your Retirement

Plan ahead for evolving housing needs, considering communities that offer multiple levels of care so you can transition smoothly as your lifestyle or health changes.

Build a financial plan that supports long-term stability, including potential shifts from independent living to assisted living or memory support if needed.

Prioritize access to health care and wellness programs, choosing communities with on-site services, preventive care options and partnerships with local medical providers.

Seek environments that support social connection and purpose, such as communities with robust activities, clubs and opportunities to build meaningful relationships.

Leverage supportive technologies and services, from safety monitoring to transportation and concierge assistance, to maintain independence and quality of life as your needs evolve.

Conclusion

Ultimately, choosing where to retire comes down to balancing financial stability, quality of life and the lifestyle that feels most fulfilling. By understanding each state’s strengths and challenges, retirees can make a confident, informed decision that supports a comfortable and rewarding next chapter.